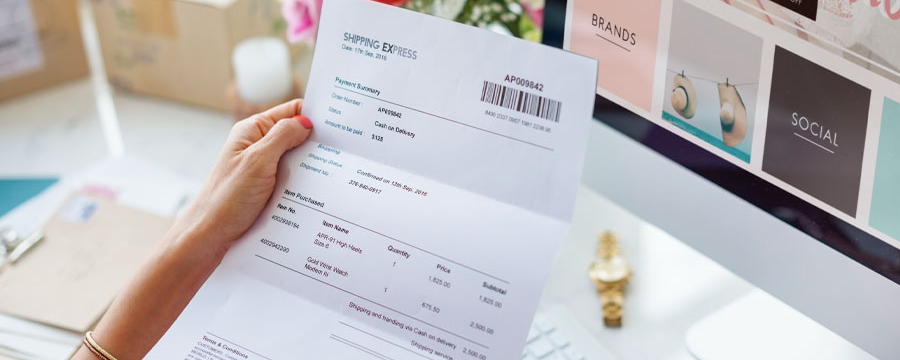

In the world of business, invoicing serves as a crucial element in maintaining financial stability and organizational efficiency. An invoice is a commercial document that serves as a formal request for payment after goods or services have been provided. This document not only acts as a record of the transaction but also assists in maintaining accurate accounting records, facilitating smooth communication between parties, and ensuring legal compliance.

While the format and layout of an invoice may vary depending on the specific needs of a business, there are several key requirements that every invoice should meet. In this article, we will delve into these important requirements, focusing on how they contribute to the overall professionalism and effectiveness of the invoicing process.

1. Accurate Identification of Parties Involved

An invoice must include the legal names and relevant contact details of both the seller (the provider of goods or services) and the buyer (the recipient of those goods or services). This information helps establish a clear and identifiable relationship between the parties involved, preventing any confusion or ambiguity.

2. Sequential Invoice Numbering

To ensure the organized filing and tracking of invoices, each invoice should possess a unique and sequential identification number. This numbering system helps both the seller and the buyer to easily reference and locate specific transactions when needed. Additionally, it enhances the overall accounting process and facilitates accurate financial reporting.

3. Date of Issuance

The date of issuing an invoice is critical for record-keeping purposes and compliance with tax and accounting regulations. It enables businesses to track payment deadlines, monitor the cash flow, and establish a chronological order for their financial transactions. The date should be clearly mentioned on the invoice, ensuring transparency and clarity for both parties.

4. Description of Goods or Services

An invoice should provide a detailed description of the goods or services provided. This includes the type, quantity, unit price, and any applicable discounts or taxes. A comprehensive description helps the buyer effortlessly identify the products or services associated with the invoice, confirms the accuracy of the transaction, and serves as an essential reference for future dispute resolution or accounting audits.

5. Clear Payment Terms and Conditions

To avoid any misunderstandings or conflicts, the invoice should clearly outline the agreed-upon payment terms and conditions. This includes specifying the payment due date, accepted payment methods, additional fees or penalties for late payments, and any applicable discounts. By setting out these terms clearly, the invoice helps establish a mutual agreement, promotes timely payments, and sets expectations for both parties involved.

6. VAT or Sales Tax Information

Depending on the jurisdiction, an invoice may need to include value-added tax (VAT) or sales tax information. This tax-related information ensures adherence to legal requirements and permits accurate taxation. The inclusion of VAT or sales tax details aids in financial reconciliation, tax reporting, and compliance with applicable regulations.

7. Contact Information for Inquiries

It is vital for an invoice to provide contact details of both the seller and the buyer, making it easy for either party to reach out in case of any queries or issues. Including a contact name, phone number, email address, and physical address contributes to effective communication and smooth problem resolution. This encourages transparency between the parties and fosters a positive business relationship.

8. Company Logo and Branding

While not mandatory, incorporating a company logo and branding elements on an invoice enhances professionalism and strengthens brand recognition. A well-designed and visually appealing invoice leaves a positive impression on the buyer, reinforcing the company’s reputation and commitment to quality.

9. Compliance with Legal Regulations

An invoice must comply with various legal regulations, which may vary from country to country. These regulations include adhering to specific invoice formats, maintaining records for a certain period, and providing accurate tax-related information. Compliance ensures that the invoice is legally valid and helps businesses avoid penalties or legal consequences.

10. Confidentiality and Data Security

To protect sensitive business and financial information, an invoice should be treated with the utmost confidentiality and should follow relevant data security measures. This includes securely storing, transmitting, and disposing of invoices to maintain data privacy and prevent unauthorized access or usage.

In conclusion, an invoice is a crucial document in the business world, serving multiple purposes such as record-keeping, communication, and legal compliance. By meeting the essential requirements discussed in this article, businesses can ensure the accuracy, professionalism, and efficiency of their invoicing processes. Adhering to these requirements not only promotes transparency and trust between parties but also contributes to the overall success of any business operation.